%20can%20help%20turn%20your%20goals%20into%20reality.%20It%20can%20be%20a%20great%20way%20to%20help%20finance%20major%20expenses%20as%20it%20allows%20you%20to%20maximize%20cash%20flow%20when%20you%20need%20it%20the.png)

The recent flooding in our community has left many homeowners facing unexpected cleanup, repairs, and replacement costs. In times like these, having access to flexible financing options can make a big difference in getting your home—and life—back on track.

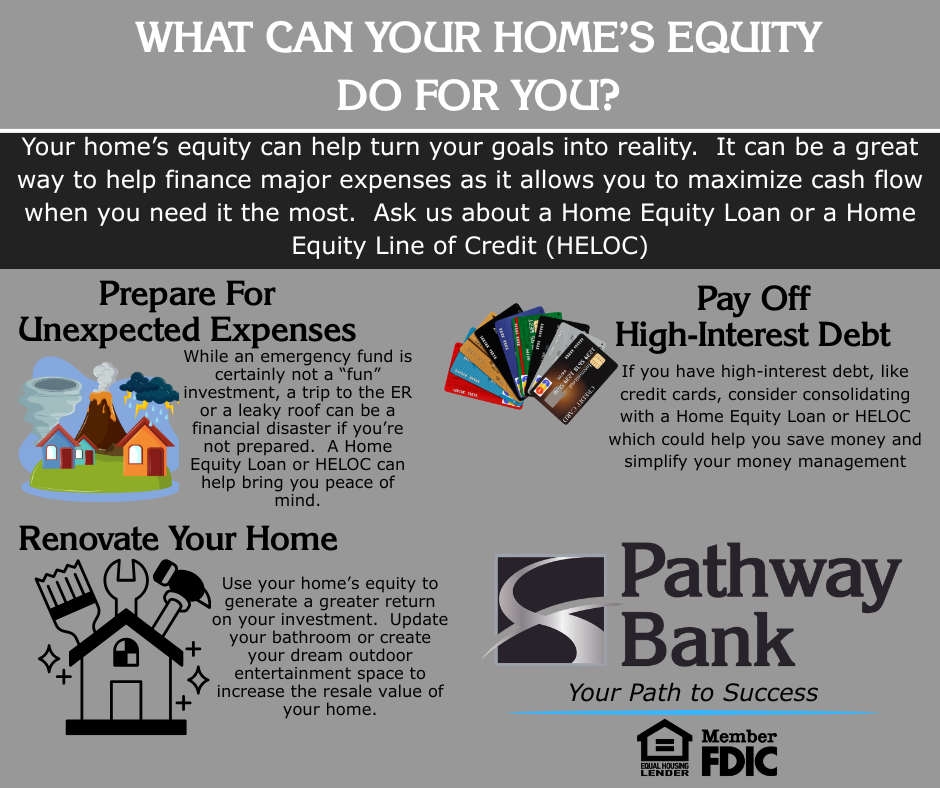

At Pathway Bank, we understand that standard homeowners insurance may not cover certain types of water damage, especially from flooding. If you've experienced damage to your property, a Home Equity Loan or Home Equity Line of Credit (HELOC) may offer the support you need to cover repairs and recovery costs.

What Are Home Equity Loans and HELOCs?

Home Equity Loan: A fixed-rate loan based on the equity you’ve built in your home. It provides a lump sum that can be used for large expenses like home repairs or remodeling.

Home Equity Line of Credit (HELOC): A revolving line of credit that lets you borrow as needed, up to your approved limit. It's a flexible option for ongoing or staged repairs.

How Can These Help After a Flood?

Cover costs not covered by insurance

Fund immediate repairs to prevent further damage

Pay for new appliances, flooring, or structural work

Finance temporary living arrangements if your home is uninhabitable

We’re Here to Help

Our team is ready to walk you through your options and help determine if you qualify. We know this is a difficult time for many of our neighbors, and we’re committed to helping you rebuild with compassion and clarity.

Stop by your local Pathway Bank branch, call us, or contact us online to schedule a time to talk. Let us help you turn equity into relief when you need it most.

All loans are subject to credit approval. Terms and conditions apply. Property insurance required. Flood insurance may be required depending on location.